Super Size EV Automotive's obesity crisis

The automobile has given society a major benefit in mobility, at the cost of an environmental impact which is now seen as unsustainable. There are now around 1.5 billion cars on roads around the world, coming in many shapes and sizes, and being put to a panoply of uses. While pollutant emissions have to a significant extent been solved on the latest internal combustion engined vehicles in developed economies, this is not true of the main global warming gas, carbon dioxide (CO2). To address this, battery electric vehicles (BEVs) are being pushed by a particularly vocal group of influencers, as if they are a panacea. Joining this call are governments from the world, which may make their takeover inevitable.

But: when the problem is the environment impact of mass mobility, we need to ask ourselves whether encouraging vehicles that are on average 39% heavier, 40% bigger and 44% more expensive to buy than normal gasoline internal combustion engine (ICE) cars is really the immediate answer.

The size issue is not confined to BEVs. Gasoline SUVs, of which there are over 200 million in the world, are 27% heavier than smaller, gasoline hatchbacks, as shown in the graph below. This shows how the kerb weight – i.e. the vehicle empty but with a full tank of fuel – averaged over all new vehicles on sale in Europe has changed over time. In our last newsletter, Gaining Traction, Losing Tread, we set out the issue of tyre wear emissions, which shows that weight matters for environmental pollution. The excess weight of BEVs is likely to lead to 8.6 mg/km of additional tyre particulate mass emissions, and gasoline SUVs an excess over hatchbacks of 5.3 mg/km, both above the total maximum permitted total tailpipe particulate emissions of 4.5 mg/km.

Looking at the trend in average vehicle weight in different categories over the last twelve years, collated from manufacturer data, we can see the clear rising trend for BEVs, as large SUVs have come to dominate a category that started with smaller hatchbacks and saloons. The weight of gasoline SUVs has stayed relatively constant, but market share has shifted in their direction.

Put in a longer historical context, European vehicles became almost 500 kg lighter in the decade after 1997 as small city cars proliferated and, further back, US cars became 400 kg lighter in the five years from the 1973 oil crisis. Therefore, a growing waistline is not predestined.

So, why are vehicles getting bigger and heavier? There are three reinforcing trends. First, consumer preferences appear to be shifting in favour of large, high-riding vehicles, with Europe catching up with earlier trends in the US. Second, more safety equipment and designs have been deployed in response to legislation and consumer pressure. The third factor is regulation, which has, perhaps unintentionally, accelerated the trend. In the US, larger pick-up trucks are exempt from the corporate average fuel economy rules, and there is a ‘footprint’ adjustment that gives easier targets for physically larger vehicles. In Europe, there is a similar adjustment to the CO2 targets, giving easier targets to heavier vehicles. More generally, the deployment of more exhaust after-treatment technology to meet ever-tighter pollutant emissions regulation has required more physical space on the vehicle and higher prices to maintain profit margins. In simple terms, CO2 emissions have been increased to serve consumer preference and air quality gains.

Along with the added weight of BEVs and gasoline SUVs comes greater physical size. The average BEV from the last five years is 44 cm longer, 9 cm wider and 33 cm higher than the average gasoline vehicle. This equates to an excess volume of 40%. This has positives in terms of consumer utility where it leads to greater interior space and better access, but may come with downsides in terms of on-road practicality and safety. According to an estimate from the US, if you are hit by a vehicle 450 kg heavier than yours, the risk of death is 47% greater than if the vehicles were of the same weight.

With this extra size and weight typically comes higher CO2 emissions, whether that is from the manufacture of the vehicle or during usage. Plotting the real-world tailpipe CO2 emissions against weight, from Emissions Analytics’ EQUA test programme of hundreds of vehicles using Portable Emissions Measurement Systems since 2011, we see a positive correlation: each extra 100 kg of vehicle mass adds on average 13.9 g/km to in-use exhaust emissions, as shown in the chart below. This is likely to underestimate the relationship as vehicles have become more fuel efficient, like-for-like, over time. If weight is correlated to the official CO2 values over just the last five years, an extra 100 kg of mass adds 24.6 g/km.

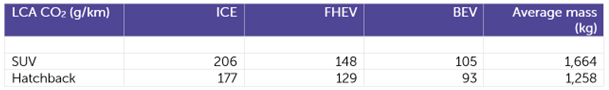

If we add in estimates for upstream CO2 emissions from the vehicle manufacture, fuel refining and electricity production – using Emissions Analytics’ proprietary lifecycle analysis (LCA) model – we can see the total distance-specific emissions over a vehicle lifetime in the table below.

For further details on the model and methods, please refer back to our previous newsletter: Schrödinger’s Car.

The table shows, on these assumptions, that BEVs deliver the largest reduction in CO2 – roughly halving the emissions of the equivalent ICE vehicle. However, if we were to revert to the previously most popular bodystyle, the hatchback, and applied the latest hybridisation, using less than 2 kWh of battery, battery electric SUVs are 19% lower in CO2 emissions, due primarily to the difference in vehicle mass.

But this is not the end of the story, as with greater size and weight also comes higher purchase prices. In 2022, the average list price of BEVs on sale in the UK is £37,003, compared to £25,771 for gasoline ICEs. Full hybrids (FHEVs) – those with the capability of some driving on battery only but without the possibility of external charging – cost on average £25,745, but the hatchback subset of these comes in at just £17,577.

The risk, therefore, is that, without significant taxpayer subsidy, consumers will hold back from buying BEVs. This is perhaps being seen for the first time in the softening market share figures for BEVs in the first quarter of 2022 in the UK and Europe. This in turn may lead to consumers buying new ICE vehicles, but many will be put off by the threat to residual values and utility of looming statutory bans. Instead, many may simply opt to hold onto their existing ICE vehicle or buy second-hand, keeping them on the road longer than normal.

Currently, 14 years is the average lifespan of a vehicle in Europe. If this were to increase due to the high price of BEVs, it would covertly undermine the CO2 reduction of BEVs until all the ICE vehicles were off the road. Taking the UK car parc of around 32.5 million vehicles and a typical number of new car transactions of around 2.1 million per year, we can model three scenarios: reverting to 100% gasoline ICE vehicles, shifting all new cars to BEVs by 2030, and shifting exclusively to FHEVs at the same rate.

Although current new car sales are running at 1.6 million per year due to a combination of the economic environment and supply chain disruption, we have assumed a reversion to the usual level of 2.1 million per year soon. We can assume that a switch to FHEVs would not affect the quantity demanded as the average price is similar to an ICE vehicle. The question is the degree to which, other things being equal, the quantity of BEVs demanded would be affected by their higher relative price. According to recent research from Norway, the price elasticity of demand for BEVs is -1.27, i.e. demand falls by 1.27% for every 1% increase in price. If we further assume that 41% of car buyers are actively considering a BEV in the next five years, this would imply a reduction in sales of up to 480,000 per year due to the price premium. In other words, sales could remain subdued at around 1.6 million per year rather than recovering. Countering this argument would be the valid point that BEVs are cheaper to operate, although consumers tend heavily to discount future benefits.

With a lower level of new car sales, but assuming no reduction in demand for car usage, the average lifespan of a vehicle would likely increase. According to Emissions Analytics’ model, that increase would be from 14 to 17 years on average. On a lifecycle basis through to 2050, the effective fleet average CO2 emission on the base ICE scenario is 223 g/km. On the BEV scenario, this falls to 156 g/km. The FHEV scenario would be 181 g/km, but if these FHEVs were exclusively hatchbacks it would be just 158 g/km on average. These values lead to the cumulative CO2 figures through to 2050 in the chart above. Therefore, given the current realities of BEV pricing, and accepting the compromise in utility from a hatchback, a strategy of hybridisation is just as good as an immediate BEV migration, but with the benefit of needing less taxpayer support.

This analysis of course takes the specifications and prices of current vehicles. The only future forecast used is around the forecast decarbonisation of the electricity grid. If BEVs and SUVs become relatively lighter or cheaper over time, or the CO2 intensity of manufacture or energy production falls, different conclusions would be drawn. Therefore, for BEVs to be the optimal way forward that is often proposed, focus needs to be on addressing these factors affecting CO2, rather than subsidising the uptake right now. Finally, we must also recognise the on-going CO2 reduction benefits of BEVs after 2050 compared to FHEVs, which holds so long as battery durability matches the current lifespan of vehicles, which was discussed in our previous newsletter, Why battery durability matters for decarbonisation.

All in all, for the next decade, is it not better to incentivise smaller, hybridised vehicles as a more efficient, lower-risk and intuitive solution to CO2 emissions? Surely urban environments would be more pleasant with small, light vehicles moving around than the “electric tanks” quoted by Neil Winton in Forbes. Surely, this would also help preserve the affordability of vehicles for a wide population? Should vehicle weight even be regulated, as a good proxy for low emissions and high CO2-reduction efficiency? Such an approach may even be a way to reinvigorate EuroNCAP crash safety ratings that according to some now focus so much on the presence of driver safety aids of debatable efficacy.

It is true that such an approach would be crimping people’s liberty to some extent, by incentivising people to forgo the trappings of big SUVs. However, all directions in environmental improvement require some compromise, and this may be a smaller compromise than the available alternative options. This would be a dramatically different, and potentially much more effective, route to environmental improvement than the combination of fleet average CO2 targets and the proposed Euro 7 emissions regulations that seem destined to super-size the car parc in an unhealthy.